The Growth of Digital Lending Market in India

Updated On : April 2020Digital Transformation has completely changed the Lending system in India. This has become possible with the shrinking gap between the new technologies and the lending system. The rapid development of smartphone users, digital access and a shift towards consumerism have helped fuel the growth of Digital lending.

Content Source: Mckinsey Digital

The Growth of Digital Lending Market in India

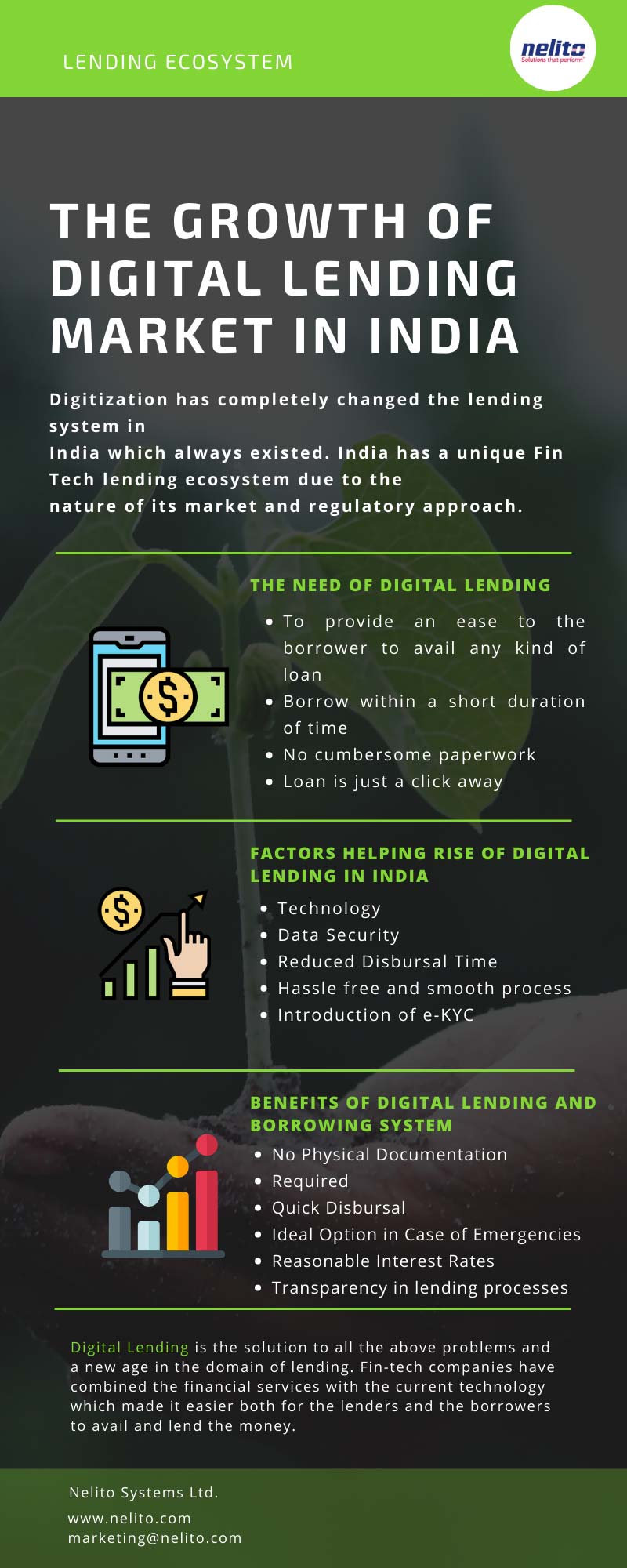

Digitization has completely changed the lending system in India which always existed. India has a unique Fin Tech lending ecosystem due to the nature of its market and regulatory approach.

The Need of Digital Lending

- To provide an ease to the borrower to avail any kind of loan

- Borrow within a short duration of time

- No cumbersome paperwork

- Loan is just a click away

Factors helping Rise of Digital Lending in India

- Technology

- Data Security

- Reduced Disbursal Time

- Hassle free and smooth process

- Introduction of e-KYC

Benefits of Digital Lending and Borrowing System

- No Physical Documentation

- Required

- Quick Disbursal

- Ideal Option in Case of Emergencies

- Reasonable Interest Rates

- Transparency in lending processes

Digital Lending is the solution to all the above problems and a new age in the domain of lending. Fin-tech companies have combined the financial services with the current technology which made it easier both for the lenders and the borrowers to avail and lend the money.

Comments :