The Role of Design Thinking in Banking & Finance Industry

Updated On : March 2018

These days’ banks talk a lot about the consumer experience, formulation and thinking like a startup, which is nothing but a part of “Design Thinking”. There is wide concern in the banking industry that a significant stake of revenues and the conventional styles of operating business are at risk owing to the evolution of fintech start-ups that are challenging the established players. In the present economic environment, banks are seeking to shape and unfold their business models to match these demands and opportunities. Design Thinking is a pragmatic tool that can help banks in their endeavours.

The banking sector is going through a course of disruption, but this not the end of the industry. Instead, this disruption marks the provenance of the banking sector’s new gene: a mix of advances in business models, agile execution, and Design Thinking.

The banking sector is going through a course of disruption, but this not the end of the industry. Instead, this disruption marks the provenance of the banking sector’s new gene: a mix of advances in business models, agile execution, and Design Thinking.

What Actually is Design Thinking?

Design thinking is generally perplexed with visual design. But the fact is that, “Design is not just what it looks like and feels like. Design is how it works” – Steve Jobs, Co-founder Apple. Design thinking is user-focused attitude to problem solving.

Design thinking is generally perplexed with visual design. But the fact is that, “Design is not just what it looks like and feels like. Design is how it works” – Steve Jobs, Co-founder Apple. Design thinking is user-focused attitude to problem solving.

And it is less about thinking and more about doing. The major players of the financial world are transitioning from the inside out, placing the consumer experience before their business and design thinking is at the fore of that.

In a digital world laden with choice, banks’ customers need choice, empathy and ease of use designed into every communication they have with the bank and they need to deliver on that speedily, before their competitors, which now include retailers and other non-banking financial institutes. We can rather say that Design thinking is shifting bank operations away from “managing” and more toward innovating. It is nothing but the consolidation of analytical thinking and intuitive thinking.

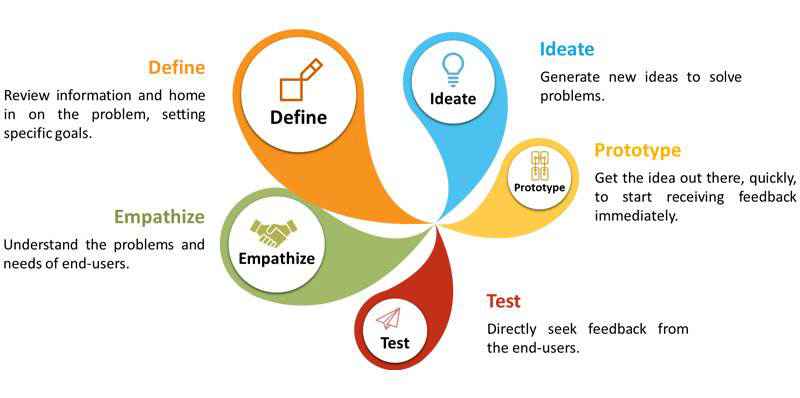

DESIGN THINKING PROCESS OVERVIEW

Practically speaking, the Design Thinking process can be split in the following five stages: Empathize, Define, Ideate, Prototype, and Test.

Though Design Thinking is optimistic, but still just a fresh approach of managing business for Banks. They’ve realized they no longer dictate how they do business and what they produce; their customers do.

Leave Comments :

Latest Blog

-

Top 5 Fintech Trends to Watch in 2025 Updated

On : April 2025

Top 5 Fintech Trends to Watch in 2025 Updated

On : April 2025

-

The Top 10 NBFCs in India 2025 Updated

On : April 2025

The Top 10 NBFCs in India 2025 Updated

On : April 2025

-

The Top 10 Powerful Women Who Changed the Financial Industry in 2025 Updated

On : February 2025

The Top 10 Powerful Women Who Changed the Financial Industry in 2025 Updated

On : February 2025

-

The Top 10 Co-operative banks in India 2025 Updated

On : March 2025

The Top 10 Co-operative banks in India 2025 Updated

On : March 2025

-

The Top 10 Microfinance Companies in India 2025 Updated

On : January 2025

The Top 10 Microfinance Companies in India 2025 Updated

On : January 2025

Comments :

I loved one your post and here you shared great things of how design thinking help your business in finance sector & grow it new level with ease.

Thanks for sharing!!